From this week's Herald and Post...

April not only brings with it lighter evenings and (hopefully) some more spring like weather (less rain please!) but it also marks the start of the new financial year.

You know a new financial year is coming when you see a lot more ads for ISAs. But it also means the annual uprating in benefits and a number of significant changes from the Budget have come into effect, on either the 1st, 6th or 8th of this month.

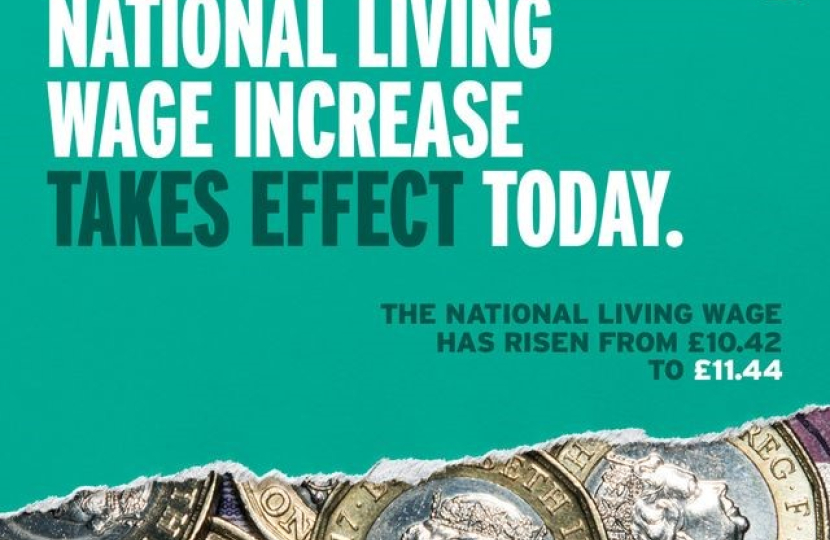

Over the last several years there has been a big cumulative increase in the legal minimum hourly pay rate. This has already meant a reduction in the proportion of work that is low-paid by half since 2015.

Now the National Living Wage (NLW) is going further, up to £11.44 an hour, benefiting over two million people.

National Insurance payments have been reduced by a further two percent for most employees and, when added to the earlier two pence cut in January, gives £900 a year back to these individuals.

Many will also benefit from the changes to the child benefit cap, which I have recently written about in this column.

The start of a major increase in early years support also begins this month, with the roll out of 15 hours of funded childcare in term-time for working parents’ two-year-olds.

This programme will be expanding further, with a staggered approach so childcare providers have time to prepare for the changes, so there can be the number of places to meet demand.

From this September, 15 hours of childcare will be extended to children from the age of nine months. Then, from September 2025, working parents of children under the age of five will be entitled to 30 hours.

Altogether, this is a dramatic increase and will, I hope, enable many parents who want to return to the workplace, to be able to, knowing much of their childcare costs are covered.

Inflation-linked benefits uprating also happens in April. Although inflation is now lower, it is the rate from September 2023 that is used for the calculation, so the main working-age benefits – such as Universal Credit – rise by 6.7%.

For those no longer working, the ongoing pensions ‘triple lock’ means a higher rise, of 8.5%, in line with earnings growth at the time. This is worth around £900 on the full state pension, broadly equivalent to the effect of the two National Insurance cuts.

Also very relevant to pensioners, and others: the ‘energy price cap’ for a typical household drops 12%, to the lowest level since Putin's invasion of Ukraine.

That will help on what remains the most important thing economically this year: inflation coming down.